Managing finances is often the most daunting aspect of running a small business. With the right approach, you can build financial clarity, stay on top of everyday cash needs, and use data to make smarter decisions.

1. The Financial Basics Every Small Business Should Prioritize

-

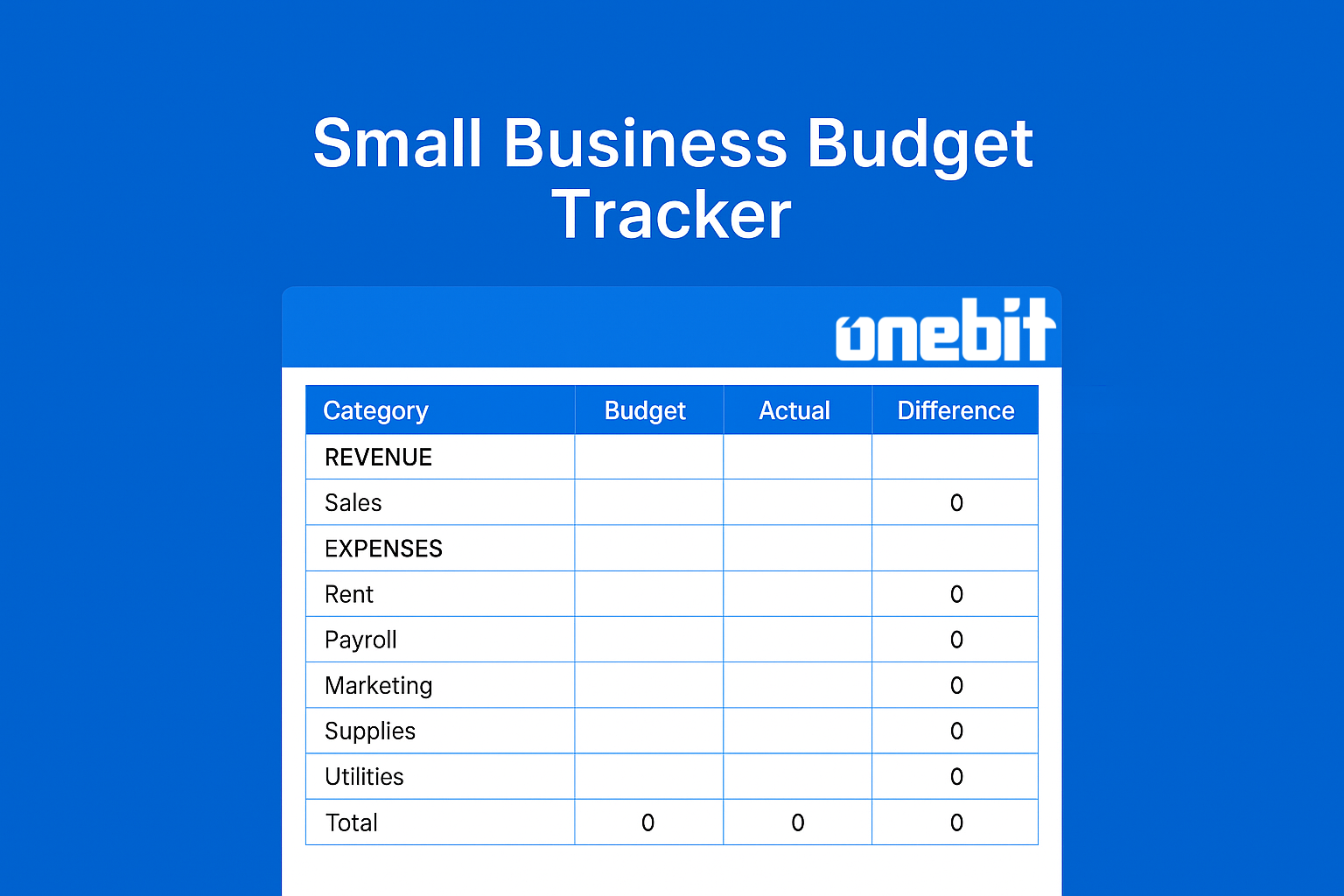

Budgeting & cash flow monitoring: Create a flexible budget that you update monthly. Track where every dollar goes and stays, so you identify trends before they become problems.

-

Expense tracking and categorization: Group expenses by type—rent, supplies, payroll—to help reduce overspending and improve budgeting accuracy.

-

Profit and loss clarity: Know your net profit or loss at a glance by comparing total sales against total expenses. It’s your baseline for profitability.

-

Tax-readiness: Keep your records organized year-round to simplify deductions, filings, and audits.

2. How ONEBIT Supports These Core Needs

You’ll notice these features align closely with managing finances effectively:

-

Real‑time cash flow tracking: Stay informed and proactive with ONEBIT‘s continuous updates on your financial inflows and outflows.

-

Automated expense tracking: No more manually entering receipts—ONEBIT links to your POS or bank and organizes transactions for you.

-

AI‑powered insights: An intelligent assistant evaluates your data and highlights trends—like a spike in spending or slow months—so you can act early.

-

Unified dashboard view: With a single platform pulling in sales, expenses, profit/loss, and trends, you gain a clear snapshot of your financial health.

By working in the background, these tools help you build habits—like tracking effectively and making data-based decisions—without feeling forced or overly complicated.

3. Best Practices to Keep Your Business Financially Healthy

1. Automate Wisely

Set up connections to your bank, POS, and bookkeeping tools so data flows seamlessly. Automation saves time and reduces errors.

2. Review Regularly—but Focused

Check key numbers weekly or monthly—revenue, margins, cash runway—to catch issues fast. Let insights highlight surprising spikes or dips.

3. Be Prepared for Taxes and Seasonality

Your tool should flag categories where you’re overspending and keep everything organized for tax time. Seasonal trends? Let your dashboard show when they hit.

4. Use AI as a Partner, Not a Replacement

Think of AI insights as friendly suggestions—not mandates. Let them guide your attention to where action matters most.

5. Build a Profit-First Mindset

Rather than treating profits as an afterthought, make them a focus: how can you trim expenses, up your margins, or invest smarter?

Final Thoughts

Managing finances for a small business doesn’t have to feel overwhelming—or lofty. By centering on core habits like real-time tracking, automated categorization, and intelligent insights, you align the right tools with responsible financial practices.

ONEBIT and similar tools are intended to complement, rather than substitute, sound financial practices. By fostering deliberate habits instead of merely offering features, these tools enable you to concentrate on customer service and sustainable business growth.