In today’s fast-paced and competitive economic landscape, financial literacy has become a fundamental skill, not just for individuals but particularly for small business owners. Financial literacy—the ability to understand and effectively use financial skills such as budgeting, investing, and financial management—can significantly influence the success and sustainability of a business. For small businesses, where resources are often limited and margins are tight, being financially literate is not a luxury; it is a necessity.

Among the many elements of financial literacy, understanding and managing cash flow stands out as one of the most critical aspects for small business owners. Without effective cash flow management, even profitable businesses can find themselves unable to meet obligations, pay employees, or invest in future growth.

The Role of Financial Literacy in Small Business Success

Financial literacy empowers small business owners to make informed decisions based on solid financial data. Many entrepreneurs start businesses because they are passionate about a product or service, but without an understanding of key financial principles, they may struggle with pricing, budgeting, forecasting, and strategic planning.

- Better Decision-Making: Financially literate entrepreneurs can interpret financial statements, assess profitability, and determine whether they can afford to expand or hire new staff. They are more likely to evaluate risks accurately and make sound decisions that align with their long-term goals.

- Improved Budgeting and Planning: With strong financial skills, business owners can create and stick to budgets, plan for lean periods, and allocate resources effectively. This allows them to anticipate future needs and avoid unnecessary debt or financial shortfalls.

- Access to Capital: Investors and lenders prefer working with financially literate business owners. When a small business can present clear, accurate financial statements and articulate how borrowed funds will be used to generate revenue, they are more likely to secure funding.

- Long-Term Sustainability: Financial literacy enables owners to track trends, identify inefficiencies, and adjust operations accordingly. It fosters a proactive approach to managing finances rather than a reactive one, reducing the likelihood of unexpected crises.

Despite these benefits, many small business owners lack adequate financial knowledge. According to various studies, a significant number of small businesses fail within the first five years, and poor financial management is often cited as a primary cause. This underscores the critical importance of both acquiring and applying financial literacy from the outset of a business venture.

Why Cash Flow Tracking is Essential

Among all the components of financial management, tracking cash flow is arguably the most important for small businesses. While profit might be the ultimate goal, positive cash flow is what keeps a business running on a day-to-day basis.

- Avoiding Insolvency

A business can be profitable on paper but still go bankrupt if it runs out of cash. This can happen if payments from clients are delayed or if the business has to pay suppliers before receiving income. By monitoring cash flow, businesses can anticipate shortfalls and take steps to mitigate them, such as renegotiating payment terms or securing a line of credit. - Meeting Financial Obligations

Every business has ongoing obligations—rent, utilities, salaries, inventory purchases, and taxes. If a business fails to meet these due to poor cash flow, it can damage relationships with suppliers, lower employee morale, and even lead to legal issues. Accurate cash flow tracking ensures that there is always enough liquidity to meet these responsibilities. - Planning for Growth

Expanding a business often requires investment—whether in marketing, equipment, staff, or facilities. Proper cash flow tracking allows businesses to determine whether they can afford to reinvest in themselves. It also helps in deciding the right time to grow and how to finance that growth without jeopardizing the current operations. - Improving Financial Forecasting

Cash flow statements give insights into a business’s earning and spending patterns. Over time, this data helps in creating more accurate forecasts, which in turn informs strategic decisions like inventory management, hiring, or scaling back during slow seasons. - Crisis Management

In unpredictable times—like economic downturns, pandemics, or supply chain disruptions—having up-to-date cash flow data helps businesses respond swiftly. For instance, a company that regularly monitors its cash flow might identify a drop in customer payments early and take corrective action before it becomes a crisis.

Tools and Practices for Tracking Cash Flow

Tracking cash flow doesn’t have to be overly complex. Many tools and practices can make it easier for small businesses to stay on top of their finances.

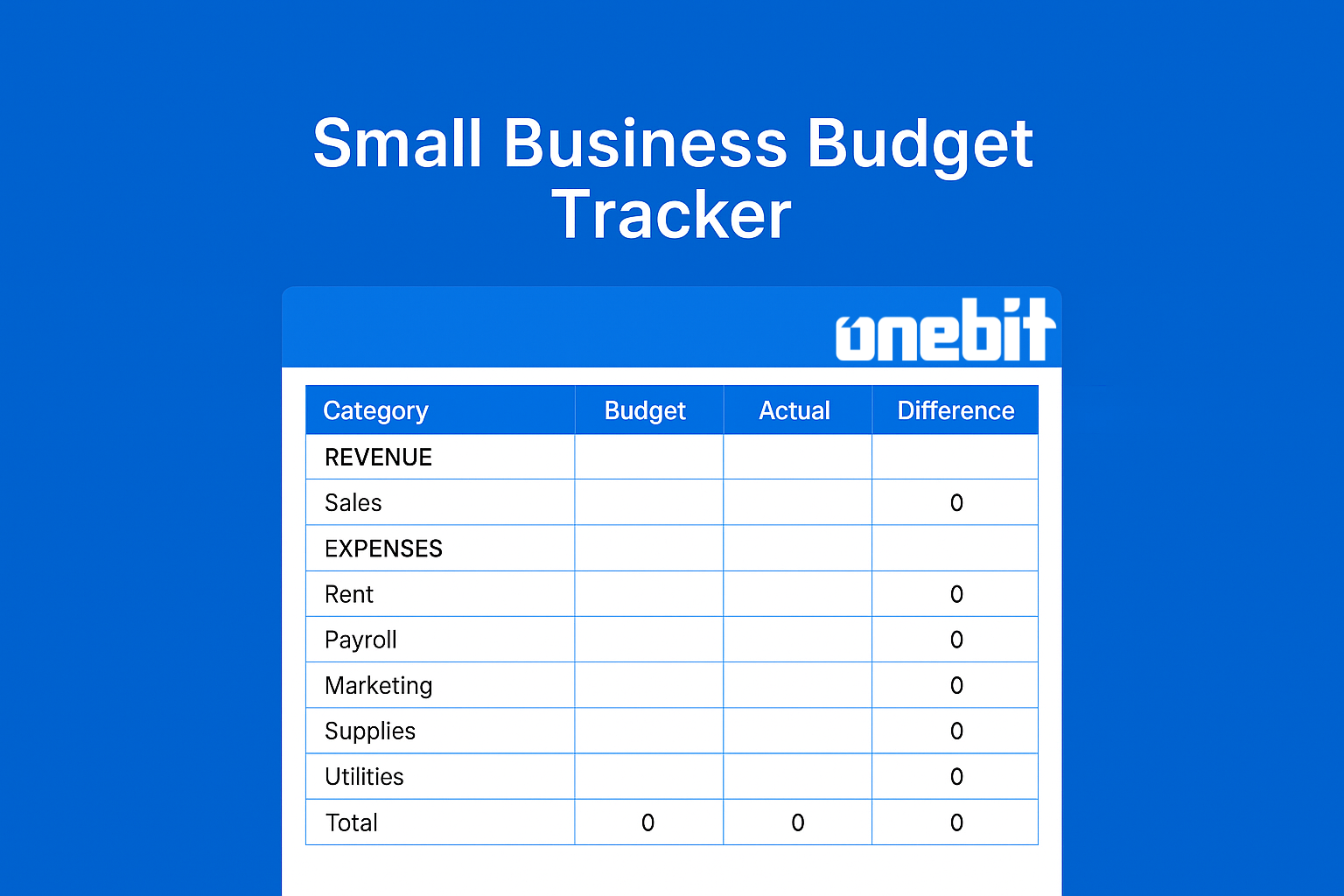

- Cash Flow Management Software: Tools like ONEBIT provide real-time insights into a business’s financial health. These platforms can automate invoicing, track expenses, and generate cash flow reports, making it easier to maintain financial discipline.

- Regular Financial Reviews: Setting a routine—weekly, bi-weekly, or monthly—for reviewing cash flow statements ensures that any anomalies are spotted early. It also keeps the business owner informed and involved in financial operations.

- Cash Flow Projections: Beyond tracking current cash flow, it’s helpful to create projections based on expected income and expenses. This forward-looking approach helps anticipate potential problems and allows for better planning.

- Separation of Personal and Business Finances: One common mistake among new entrepreneurs is mixing personal and business accounts. This not only complicates cash flow tracking but can also lead to inaccurate financial assessments.

- Working with Professionals: While software can assist with day-to-day operations, working with accountants or financial advisors ensures accuracy and compliance. They can also offer strategic advice that goes beyond simple record-keeping.

Conclusion

Financial literacy is not merely an optional skill for small business owners—it is a foundational element of sustainable business success. Without a solid understanding of financial principles, even the most innovative or in-demand businesses can falter. Among the many pillars of financial management, cash flow tracking stands out as a critical area that can determine whether a business thrives or fails.

Small business owners must view financial literacy and cash flow management as ongoing priorities rather than one-time tasks. Investing time in learning these skills, leveraging available tools, and seeking professional guidance when needed can significantly improve a business’s chances of long-term success. In the world of small business, where agility, resilience, and efficiency are key, mastering financial literacy and cash flow is not just beneficial—it’s essential.