Running a small business is both rewarding and challenging. Owners often wear many hats—managing operations, serving customers, and keeping track of finances. Unfortunately, financial management tends to be one of the biggest pain points. From cash flow tracking to expense forecasting, it’s easy for small details to get lost in the shuffle.

This is where artificial intelligence (AI) is making a real impact. By leveraging AI-driven tools, small businesses can simplify financial management, make better decisions, and gain the kind of insights that were once only accessible to larger enterprises with big finance teams.

How AI Is Transforming Financial Management for Small Businesses

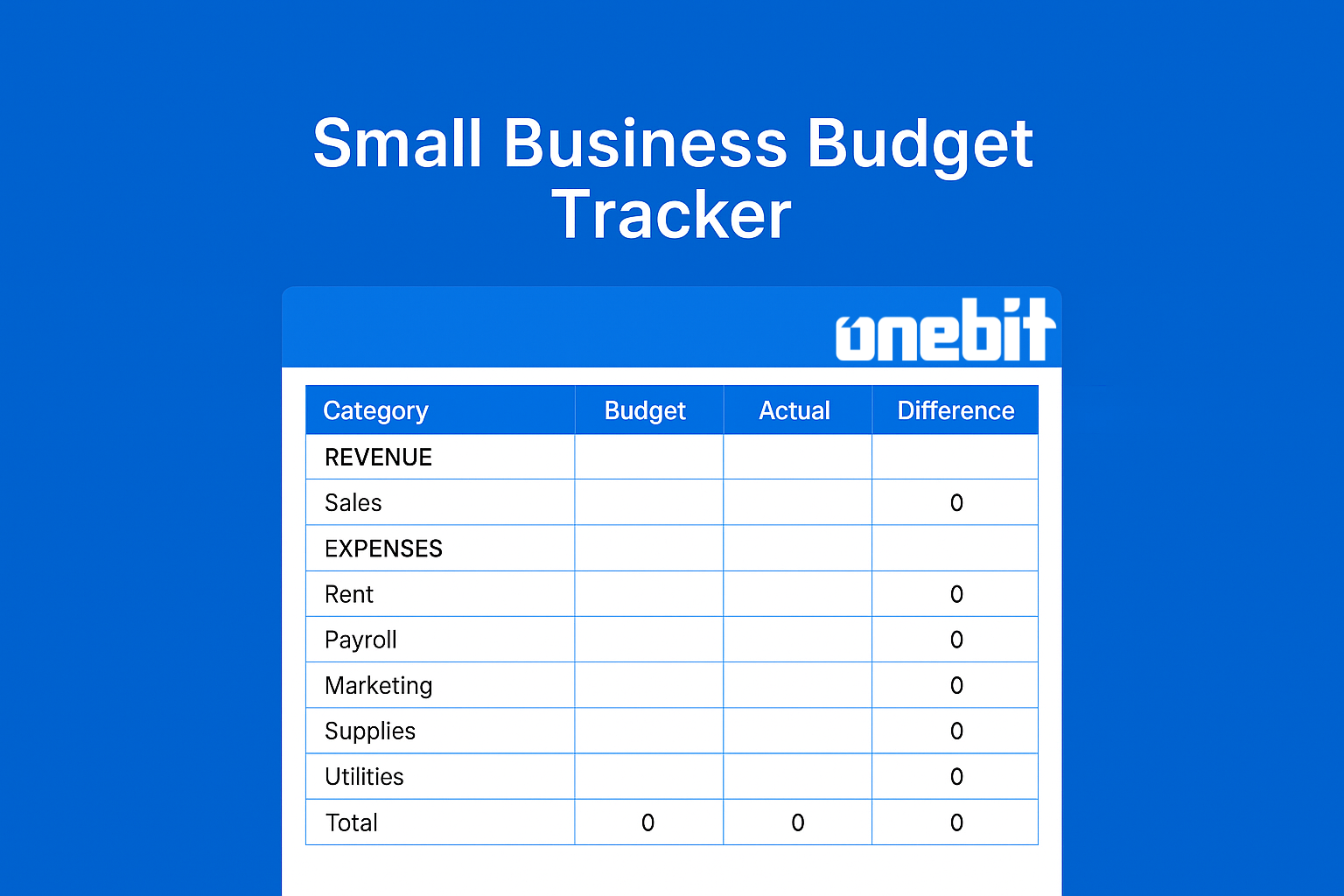

- Automated Expense Tracking

AI can automatically categorize transactions, reconcile accounts, and reduce the risk of human error. Instead of spending hours on spreadsheets, business owners get accurate, real-time records. - Cash Flow Forecasting

Predicting when money will come in—or run out—can make or break a small business. AI uses historical data and current trends to generate forecasts that help owners prepare for slow periods and plan for growth. - Fraud Detection & Security

AI systems can detect unusual spending patterns and flag potential fraud in real time, giving business owners peace of mind and protecting their hard-earned revenue. - Personalized Financial Insights

Rather than just presenting raw data, AI turns numbers into actionable advice. Business owners can see where to cut costs, when to invest, and how to optimize resources. - Time & Cost Savings

By automating routine tasks, AI frees up owners to focus on strategy, customer service, and growth instead of drowning in paperwork.

How ONEBIT Helps Small Businesses Harness AI

At ONEBIT, we believe small businesses deserve the same financial intelligence as large corporations—without the complexity. That’s why we built a user-friendly financial assistant powered by AI.

How ONEBIT Helps Small Businesses Harness AI

At ONEBIT, we believe small businesses deserve the same financial intelligence as large corporations—without the complexity. That’s why we built a user-friendly financial assistant powered by AI.

Here’s how ONEBIT supports small business owners:

- Seamless Integrations: ONEBIT connects directly with point-of-sale systems, banks, and payment processors so you have a complete view of your finances in one place.

- AI-Driven Dashboards: Instead of raw numbers, you get visual charts, graphs, and reports that make your financial health easy to understand at a glance.

- Smart Cash Flow Insights: ONEBIT predicts upcoming expenses, revenue patterns, and potential shortfalls so you can plan with confidence.

Actionable Recommendations: Our AI highlights opportunities to reduce costs, optimize inventory, or adjust pricing strategies.

The Future of Financial Management Is Here

AI is no longer a luxury—it’s a necessity for small businesses that want to stay competitive. By adopting AI-powered financial tools, owners can make faster, smarter decisions and avoid common pitfalls that derail growth.

With ONEBIT, you don’t need to be a financial expert to run your business like one. You just need the right tools that work for you, not against you.

👉 Ready to simplify your financial management?